Use Edmund’s car maintenance calculator to get an estimate of how much you’ll spend to maintain your vehicle. These costs can start at around $100 per visit but vary by the make and model of your vehicle. Make sure you understand car insurance rates and the b est car insurance companies available in order to select the best car insurance coverage for your needs. So, you can expect an older car to carry higher rates.īeyond the cost of monthly car loan payments, vehicle ownership costs can add up. Vehicle age. An older vehicle can carry additio nal risk of issues for both you and your lender.This means you can still benefit from a competitive rate if you have a strong profession or educational background - with or without a perfect credit score. Education and work history. Many lenders are expanding underwriting criteria outside of the sole measure of your credit score.But a longer-term loan will decrease your monthly payment. Loan term. Typically, a longer-term loan will equate to higher interest rates and more interest paid over the life of the loan.Vehicle down payment. Putting down a large down payment will not only bode well with lenders but will decrease the amount you are borrowing - saving you more money down the line.Very simply, the lower your credit score is, the higher your interest rate will be. Your credit history. Lenders use credit scores to measure the risk that borrowers carry.Consider these aspects and how they will affect loan approval and rates: While it is true that the interest rate you will receive varies depending on the lender and is somewhat out of your control, there are still choices you can make to increase approval. What factors contribute to auto loan interest rates?

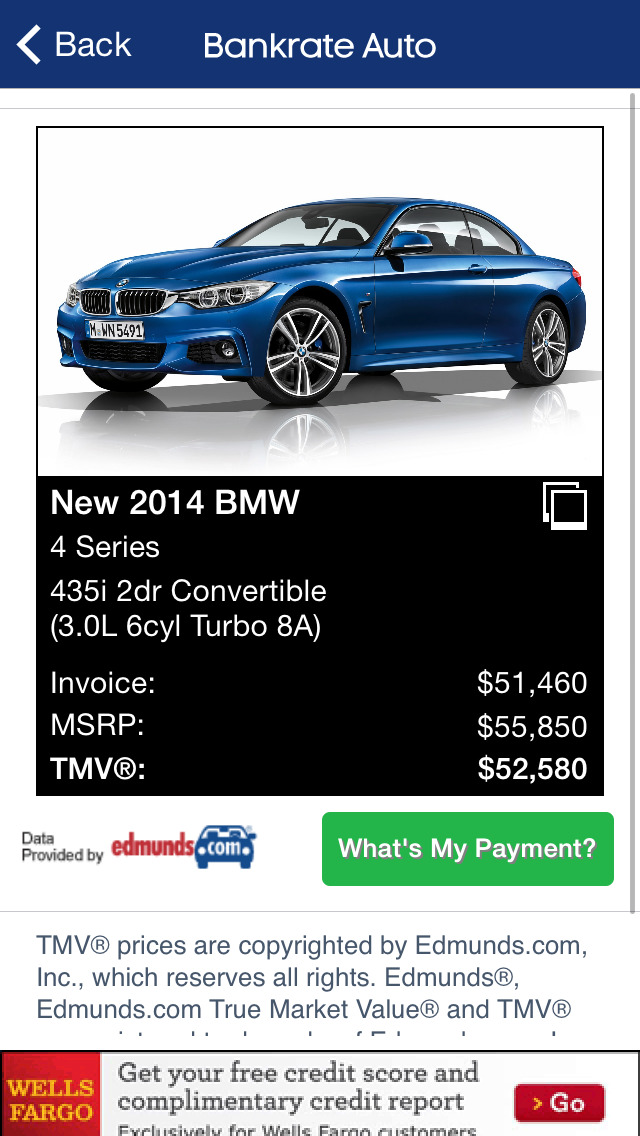

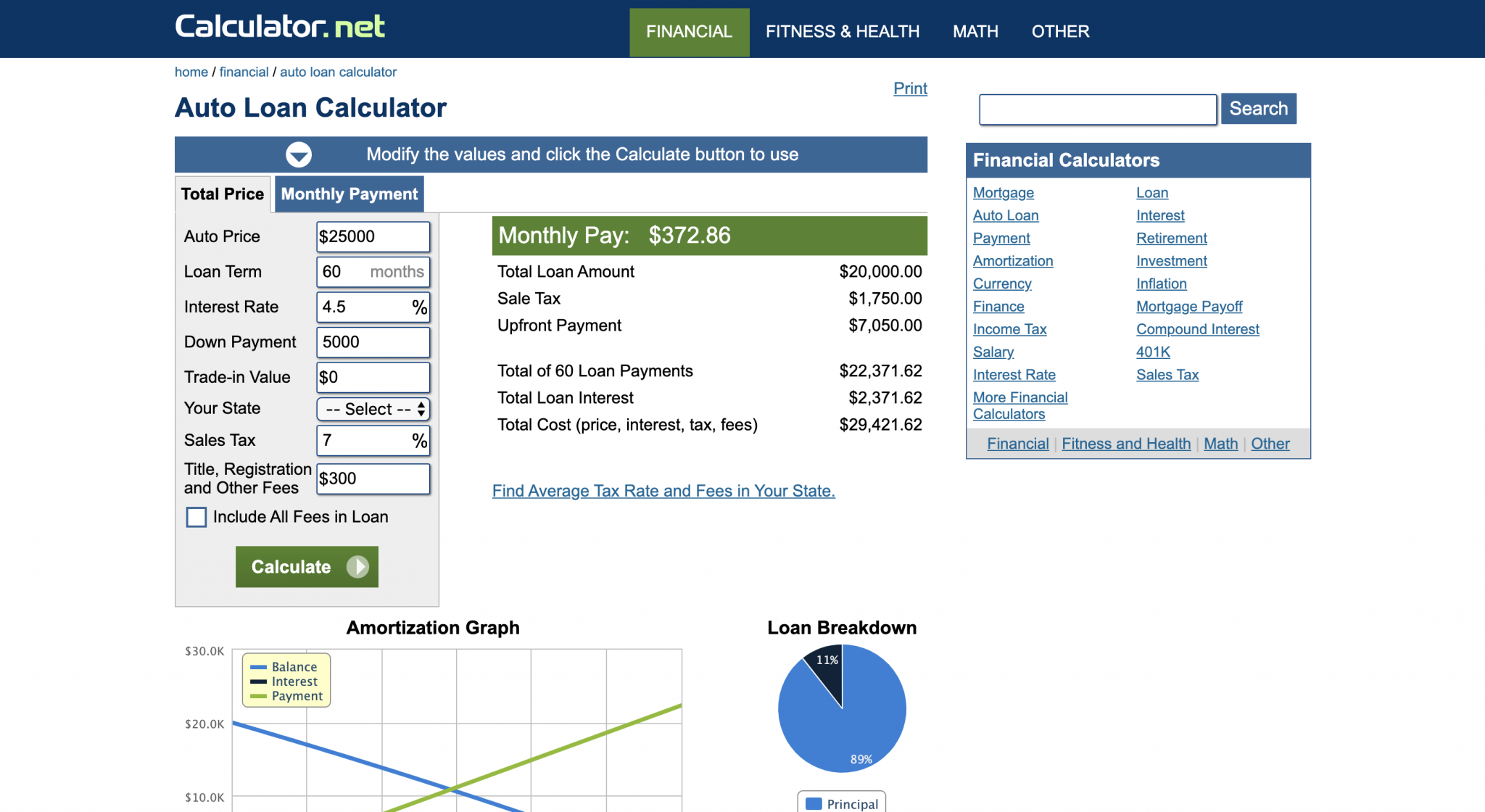

If you find a few lenders that you like, see if they offer preapproval - going through this process will let you see which rates you qualify for without affecting your credit score. The auto loan lenders listed here are selected based on factors such as APR, loan amounts, fees, credit requirements and more.Īs of July 12, 2023, the average APRs according to a Bankrate study are the following. Check the lenders’ websites for more current information. Loan details presented here are current as of July 10, 2023. Look for lenders that keep fees to a minimum and offer repayment terms that fit your needs. When shopping for an auto loan, compare APRs across multiple lenders to make sure you are getting a competitive rate. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders. You are typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Since car loans are typically "secured", they require you to use the automobile you are buying as collateral for the loan. * Find out whether your state requires vehicle inspections, smog and emissions testing, or both.Auto loans let you borrow the money you need to purchase a car. When it comes to determining how much your new (or new to you!) car will cost, monthly car payments aren't your only financial concern.įor example, when determining your vehicle budget, you'll need to consider:Įach of these factors will help you determine how much owning your new or used vehicle will actually cost in the long run. Once you complete each of these steps, our calculator will provide you with an estimated car loan amount you need to finance as well as projected monthly payments. Are you trading in a used vehicle? How much is that vehicle worth? How much money can you pay upfront for the vehicle? Generally, the higher the down payment, the lower the monthly payments. Be sure to talk with your lender about the pros and cons of shorter vs. Sometimes, the longer the loan term, the lower the monthly payments. This means how long you plan to make car payments. Currently, Bankrate provides auto loan interest rates based on three-month auto trends. Like the sales tax, the interest rate can vary greatly, often depending on whether the car is new or used how long you play to finance the car and even the date. Keep in mind, there could be a difference between the sales tax for a new vehicle and the sales tax for a used vehicle. Sales tax varies by state, so you might need to contact your local motor vehicle agency to ask. Remember, you might get a better price at the dealership this step is just to get you started. Enter the retail price of the vehicle.Our car payment calculator is designed to help you determine two estimated main factors:

0 kommentar(er)

0 kommentar(er)